WI F-01306 2014-2025 free printable template

Show details

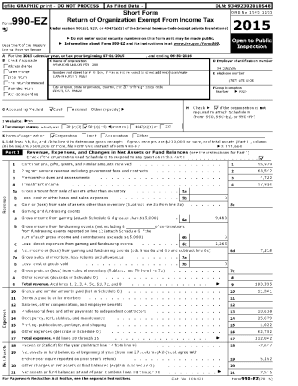

DEPARTMENT OF HEALTH SERVICES Division of Health Care Access and Accountability F-01306 07/14 State of Wisconsin Worksheet 07 SPOUSAL IMPOVERISHMENT INCOME ALLOCATION WORKSHEET Primary Person Name Last First MI Social Security Number Section A Community Spouse Income Allocation Spouse s Name Last First MI ENTER Maximum Community Spouse Income Allocation SUBTRACT Gross Income of Community Spouse - EQUALS Community Spouse Income Allocation Section B Dependent Family Member Income Allocation...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign spousal impoverishment income allocation worksheet form

Edit your income allocation worksheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WI F-01306 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit WI F-01306 online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit WI F-01306. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out WI F-01306

How to fill out WI F-01306

01

Obtain the WI F-01306 form from the appropriate state office or website.

02

Begin with filling out the applicant's personal information at the top of the form, including name, address, and contact details.

03

Provide the necessary identification information such as Social Security Number or Driver's License Number.

04

Complete the sections that inquire about your household composition, including all members of the household.

05

Fill out the income section accurately, detailing all sources of income for household members.

06

Review any additional questions or sections that are applicable to your situation, such as expenses or special circumstances.

07

Sign and date the form at the bottom to verify that all information provided is true and accurate.

08

Submit the completed form to the designated office, keeping a copy for your records.

Who needs WI F-01306?

01

Individuals or families applying for assistance programs in Wisconsin, especially those related to financial support or health services.

02

Anyone who has been instructed to complete the WI F-01306 form for processing benefits or services.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is spousal impoverishment income allocation?

Spousal impoverishment income allocation is a term used in Medicaid planning to protect the income of a spouse when one spouse requires long-term care in a nursing home or other medical facility. In situations where only one spouse requires Medicaid coverage, the income of the spouse in the nursing home is used to pay for their care, while the income of the spouse who remains at home is protected and used to maintain their living standards.

Spousal impoverishment income allocation allows the non-institutionalized spouse to keep a portion of the income for their own expenses, rather than having it all go towards the cost of care for the institutionalized spouse. The specific rules and income allowances vary by state, but they are designed to prevent the non-institutionalized spouse from falling into poverty while providing adequate care for the spouse in need.

Who is required to file spousal impoverishment income allocation?

The spouse who needs long-term care Medicaid benefits is typically required to file for spousal impoverishment income allocation. This is done to prevent the spouse with long-term care needs from depleting all their income on healthcare costs, while leaving the other spouse without adequate financial resources. However, specific eligibility requirements and rules surrounding spousal impoverishment income allocation may vary by state. It is advisable to consult with an elder law attorney or Medicaid specialist for accurate and up-to-date information regarding this matter.

How to fill out spousal impoverishment income allocation?

To fill out the spousal impoverishment income allocation, you will need to provide the required information and follow the necessary steps. Here is a step-by-step guide on how to do it:

1. Obtain the necessary forms: You will need to obtain the official form for spousal impoverishment income allocation from your state's Medicaid office or website. This form may vary depending on your jurisdiction, so make sure you have the updated and correct version.

2. Gather the required information: Before filling out the form, collect all the relevant information including personal details, income sources, expenses, and any other financial documentation required.

3. Provide personal information: Begin by providing personal details for both you and your spouse, such as full names, addresses, Social Security numbers, and Medicaid identification numbers.

4. Income information: Specify and report all sources of income for both you and your spouse. This may include wages, pensions, Social Security benefits, retirement income, rental income, investments, etc. Provide the exact amounts for each income source.

5. Deductible expenses: Report all your necessary expenses, such as rent or mortgage payments, property taxes, utility bills, health insurance premiums, medical expenses, etc. Deductibles, co-pays, and out-of-pocket expenses related to healthcare may also be included.

6. Calculate the income allocation: Once you have documented all income and expenses, calculate the income allocation. This involves subtracting deductible expenses from the total income for both spouses. The resulting amount represents the income available to the spouse seeking Medicaid coverage.

7. Sign and date the form: Ensure that both you and your spouse sign and date the completed form. Additionally, make copies of all the supporting documents for your records.

8. Submit the form: File the completed form along with any required supporting documents to the designated agency. Make sure you take note of any submission deadlines, and consider sending it through certified mail to track its delivery.

It is important to note that the process and requirements for spousal impoverishment income allocation may vary between states, so it is advisable to consult your state's Medicaid office or seek professional guidance if you encounter any difficulties during this process.

What is the purpose of spousal impoverishment income allocation?

The purpose of spousal impoverishment income allocation is to protect the non-institutionalized spouse (also known as the community spouse) from becoming financially impoverished while the institutionalized spouse receives long-term care services, typically in a nursing home. This allocation allows the community spouse to retain a certain amount of income and resources while the institutionalized spouse qualifies for Medicaid benefits. It is intended to address concerns that the cost of long-term care can deplete the couple's resources, leaving the non-institutionalized spouse with inadequate means to support themselves and maintain their standard of living.

What information must be reported on spousal impoverishment income allocation?

Spousal impoverishment income allocation refers to a process in which the income of a community spouse (the spouse not in need of long-term care) is allocated to the institutionalized spouse (the spouse receiving long-term care) in order to prevent the community spouse from becoming impoverished.

The information that needs to be reported on spousal impoverishment income allocation typically includes the following:

1. Income of the institutionalized spouse: This includes any income received by the spouse receiving long-term care, such as Social Security benefits, pension payments, rental income, etc. The exact sources and amounts of income may vary depending on the individual's circumstances.

2. Income of the community spouse: This includes any income received by the spouse not receiving long-term care. Similar to the institutionalized spouse, this may include Social Security benefits, pension payments, rental income, etc.

3. Allowance for the community spouse: The income allocation process ensures that the community spouse is able to retain a certain amount of income, known as the Minimum Monthly Maintenance Needs Allowance (MMMNA). This allowance is set by federal and state laws and is intended to prevent the community spouse from being left with insufficient income to cover their living expenses.

4. Calculation of the income allocation: The process involves calculating how much income from the community spouse will be allocated to the institutionalized spouse. This calculation is based on factors such as the MMMNA, any excess shelter and utility costs, and other applicable criteria defined by Medicaid.

It is important to note that the specific reporting requirements for spousal impoverishment income allocation may vary by state, as Medicaid rules can differ. Therefore, it is advisable to consult with a Medicaid specialist or an elder law attorney to understand the specific reporting requirements applicable in your jurisdiction.

How do I complete WI F-01306 online?

Filling out and eSigning WI F-01306 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I sign the WI F-01306 electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I edit WI F-01306 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share WI F-01306 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is WI F-01306?

WI F-01306 is a form used in the state of Wisconsin for reporting specific tax-related information to the Department of Revenue.

Who is required to file WI F-01306?

Individuals and businesses that meet certain criteria regarding their taxable income or transactions in Wisconsin are required to file WI F-01306.

How to fill out WI F-01306?

To fill out WI F-01306, you need to provide accurate financial information, including tax identification numbers, and follow the instructions provided in the form's guidelines.

What is the purpose of WI F-01306?

The purpose of WI F-01306 is to ensure compliance with Wisconsin tax laws and to collect data necessary for the state's tax assessments.

What information must be reported on WI F-01306?

The information that must be reported on WI F-01306 includes income details, deductions, tax credits, and any other pertinent financial data as required by state tax regulations.

Fill out your WI F-01306 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI F-01306 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.